Agentic AI in Wealth Management: Why Strong Processes Are the Foundation of Safe Adoption

John O'Connell2025-11-04T21:36:11+00:00Artificial intelligence is moving rapidly from experimental pilots into the core operations of wealth management firms. Among the most consequential developments is the rise of agentic AI: systems not only capable of answering questions, but of planning, making decisions, and executing tasks with a degree of autonomy. This evolution raises the stakes for the industry. Unlike traditional automation, which faithfully executes narrowly defined instructions, AI agents can interpret intent, act across systems, and adapt to new information. The promise is significant: faster onboarding, streamlined compliance checks, seamless client communication, and near‑real‑time operational insight.

Yet, as with any powerful tool, the outcome depends entirely on what it is given to amplify. An AI agent, left to run a poorly defined or inconsistently executed process, will not improve that process—it will magnify its flaws at scale. The client proposal workflow illustrates this point. If required compliance checks or client risk validations are skipped in a proposal process, an AI agent will replicate the same oversight dozens or hundreds of times, creating unsuitable recommendations at scale. Unlike human staff, who may notice an inconsistency and improvise a correction, an AI agent will execute blindly until instructed otherwise.

This white paper advances a central thesis: AI agents amplify whatever process they are given—good or bad. The strategic implication for wealth‑management leaders is clear: before granting autonomy to AI, firms must ensure their processes are robust, well documented, and aligned with both regulatory expectations and client trust. In practice, this means placing a renewed emphasis on Standard Operating Procedures (SOPs) as the foundation for safe, scalable AI adoption.

Three key findings guide this position:

- Poor processes lead to faster mistakes

- Missing steps invite hallucinations

- Strong SOPs unlock scalable advantage

Regulators continue to heighten expectations for auditability, fiduciary oversight, and operational resilience, while clients demand both efficiency and trustworthiness. Agentic AI can help firms meet these dual pressures, but only if deployed atop disciplined, transparent processes.

This paper will outline how to prioritize process discipline before deploying AI agents. Our position is that firms should conduct maturity assessments of existing workflows, invest in SOP documentation and governance, and embed compliance checkpoints into every process.

Fill out the form below to download the white paper and learn how to harness the transformative potential of agentic AI while safeguarding fiduciary duty and brand reputation.

Thanks to Jump for sponsoring this white paper, a leading provider of AI solutions for financial advisors and financial services professionals!

Related Posts

The Colonial Pipeline Ransomware Attack: A Wake-Up Call for Wealth Managers

Ransomware attacks soared 158% in North America last year and 300%... read more

Next Best Action Technologies Make One-To-One Engagement Possible

Attention spans are short. Our lives take place online more than ever... read more

Understanding Data and How to Unlock it’s Value

As the financial advisory industry has become increasingly digital, the threat of... read more

CRM Selection in Wealth Management: Beyond the Build-vs-Buy Decision 2026

This white paper, covering CRM selection in the wealth management industry and... read more

AI, Data, and Security: Inside the CTO Strategy for Elite RIAs – CTO Think Tank White Paper on WealthManagement.com

Access this white paper from The Oasis Group and WealthManagement.com, housing... read more

UNLOCKING GROWTH OPPORTUNITIES: A Security-Centric Comparison of Microsoft Copilot and ChatGPT

Wealth management firms handle significant amounts of personally identifiable information, and the... read more

Technology Leadership in Wealth Management – CTO Think Tank White Paper on WealthManagement.com

Access an insightful white paper for wealth management firms, CTOs, and technology... read more

Innovative Strategies for Financial Advisors: Harnessing the Alts Tech Advantage

Increasingly, financial advisors are incorporating alternative investments into their client portfolios. This... read more

Understanding Cybersecurity and Mitigating Risk

As the financial advisory industry has become increasingly digital, the threat of... read more

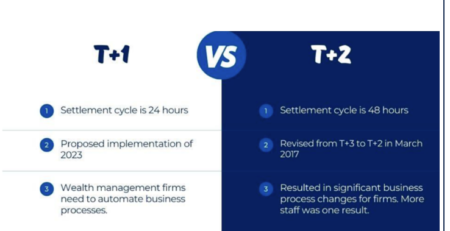

The Implications of T+1

Many firms have yet to start their planning for the eventual move... read more