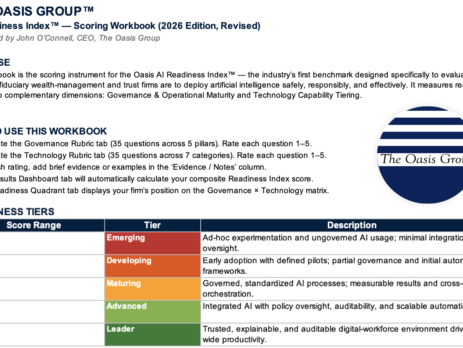

News Release: The Oasis Group Releases AI Readiness Index™, First Maturity Benchmark for Wealth Management Industry

Learn more about the Oasis AI Readiness Index™ in this news release from The Oasis Group - the industry’s first maturity benchmark built exclusively for fiduciary wealth management firms, trust firms, and family offices.